Send Money Perfect Money online has become increasingly popular, especially with the rise of digital payment platforms. Perfect Money is one such platform that offers a secure and convenient way to transfer funds globally.

In this article, we will explore the ins and outs of using Perfect Money for sending money, from setting up an account to understanding the fees associated with transfers. Whether you are a seasoned user or new to online money transfers, this guide will provide you with the essential information to make the most of Perfect Money’s services.

Contents

Introduction to Send Money Perfect Money

Looking for a sleek way to send and receive money across borders? Perfect Money might just be the perfect solution for you. This online payment system allows for quick and secure transactions, offering a range of benefits for users.

What is Perfect Money?

Perfect Money is an online payment system that enables users to make instant payments and transfers securely. It provides a convenient way to send and receive money globally, ideal for both personal and business transactions.

Read more Perfect Money To Binance Exchange

Benefits of Using Perfect Money

Why opt for Perfect Money? This platform offers low transaction fees, enhanced security features, privacy protection, and the flexibility to transfer funds in various currencies. With Perfect Money, you can enjoy quick and hassle-free transactions anytime, anywhere.

Setting Up a Perfect Money Account

Ready to get started with Perfect Money? Setting up an account is a breeze, and here’s how you can do it.

Creating a Perfect Money Account

To create a Perfect Money account, simply visit the official website and follow the registration process. Fill in your details, verify your email address, and you’re good to go. It’s that simple!

Verifying Your Perfect Money Account

For added security and access to advanced features, consider verifying your Perfect Money account. This typically involves providing additional identification documents to confirm your identity.

Funding Your Perfect Money Account

Now that your account is set up, it’s time to add funds to your Perfect Money wallet for seamless transactions.

Available Funding Methods

Perfect Money offers various funding options, including bank transfers, cryptocurrency deposits, and e-currency exchanges. Choose the method that works best for you and top up your account with ease.

Adding Funds to Your Perfect Money Account

To add funds to your Perfect Money account, simply select your preferred deposit option, enter the required details, and complete the transaction. Your account will be credited promptly, ready for sending and receiving payments.

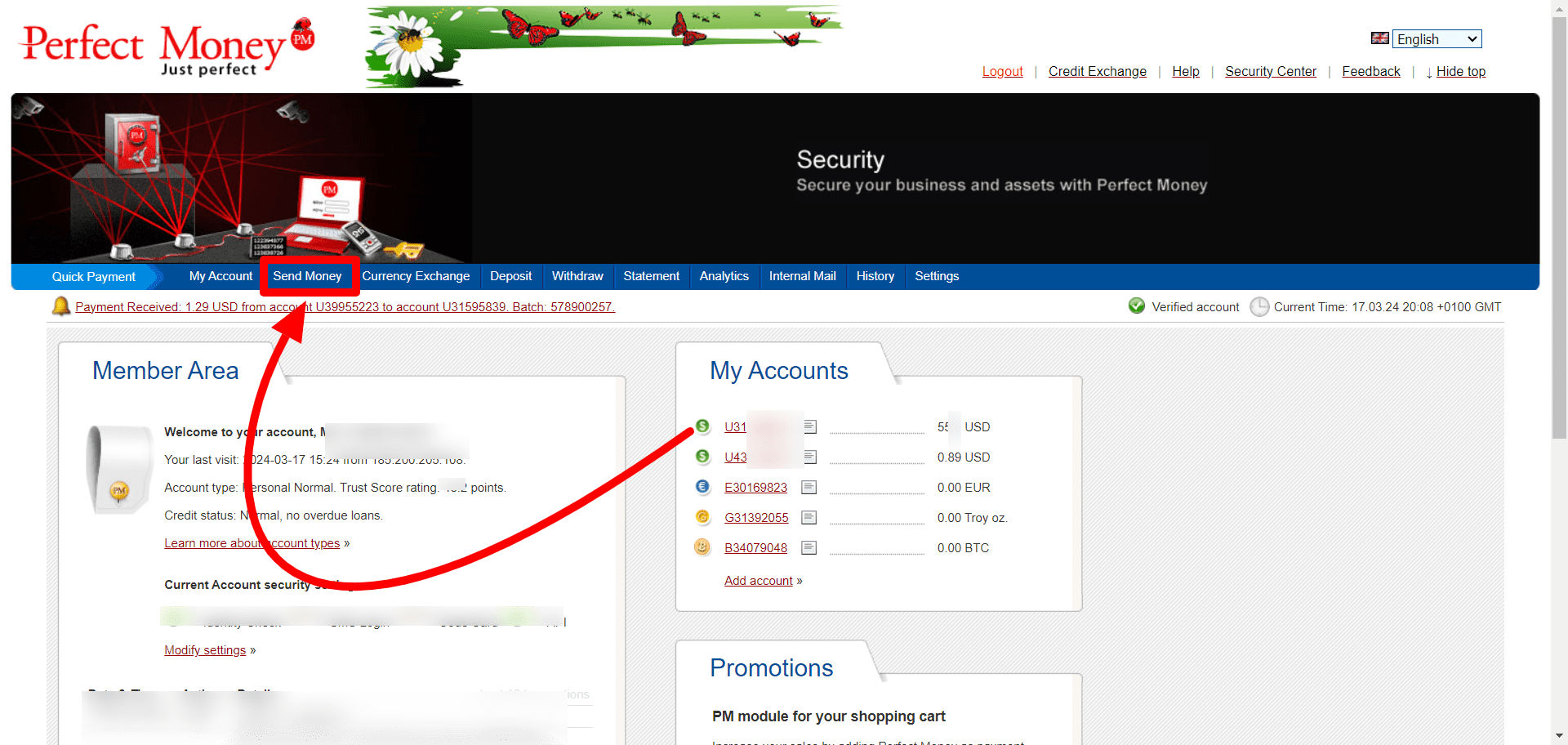

Sending Money Using Perfect Money

With funds in your Perfect Money account, sending money to friends, family, or business partners is a straightforward process.

Initiating a Transfer

To initiate a transfer, log in to your Perfect Money account, select the send money option, enter the recipient’s details, and specify the amount to be transferred. Review the transaction details and confirm to complete the transfer.

Recipient Details and Transfer Instructions

When sending money using Perfect Money, ensure you have the recipient’s correct account details to avoid any delays. Double-check the transfer instructions, including the amount, currency, and any additional notes, to ensure a smooth transaction.

Security Measures and Best Practices

Two-Factor Authentication

To beef up your security game, consider enabling two-factor authentication for your Perfect Money account. This adds an extra layer of protection by requiring a second form of verification besides your password, making it harder for cybercriminals to gain unauthorized access.

Avoiding Phishing Scams

Stay sharp and watch out for phishing scams that impersonate legitimate Perfect Money websites or emails to trick you into revealing sensitive information. Always double-check website URLs, never click on suspicious links, and never share your account login details over email or messages.

Fees and Charges Associated with Perfect Money Transfers

Overview of Fees

Before sending money through Perfect Money, familiarize yourself with the various fees involved, such as transaction fees, withdrawal fees, and deposit fees. Knowing these charges upfront can help you plan your transfers more effectively.

Understanding Exchange Rates

Be mindful of exchange rates when sending money internationally through Perfect Money. Exchange rates can impact the final amount received by the recipient, so it’s essential to stay informed about the prevailing rates to ensure you’re getting the best value for your transfer.

Alternative Money Transfer Options to Consider

Comparison with Other Payment Platforms

While Perfect Money offers convenience and flexibility, it’s worth exploring other payment platforms like PayPal, Skrill, or Payeer to compare fees, transfer speeds, and supported currencies. Different platforms have their pros and cons, so find the one that best suits your needs.

Exploring Traditional Banking Options

Don’t overlook traditional banking options for money transfers, especially for larger transactions or when sending money to countries where digital platforms may have limitations. Banks offer secure wire transfers and may provide competitive exchange rates, so weigh your options before making a decision.In conclusion, Perfect Money offers a reliable solution for sending money seamlessly across borders. By following the steps outlined in this guide and implementing the recommended security measures, you can make the most of this platform’s features while ensuring the safety of your transactions. Whether you are making personal payments or conducting business transactions, Perfect Money provides a user-friendly and efficient way to manage your financial transfers.