Payeer, a digital payment service, has gained significant attention in the global financial technology market. This article delves into the availability of Payeer in Bangladesh, exploring its potential impact on the country’s digital payment landscape. As digital transactions continue to rise in popularity, understanding the features, benefits, and security considerations of Payeer becomes essential for individuals and businesses alike.

By examining Payeer’s expansion into Bangladesh, the process of creating an account, and its usability for online transactions, we aim to provide a comprehensive overview for Bangladeshi users. Additionally, we will explore the potential advantages and challenges associated with Payeer’s presence, ultimately assessing its role in shaping digital payments in Bangladesh.

Contents

- 1 1. Introduction to Payeer

- 2 2. Overview of Digital Payment Services in Bangladesh

- 3 3. Availability of Payeer in Bangladesh

- 4 4. Benefits and Features of Payeer for Bangladeshi Users

- 5 5. How to Create a Payeer Account in Bangladesh

- 6 6. Using Payeer for Online Transactions in Bangladesh

- 7 7. Security and Privacy Considerations with Payeer in Bangladesh

- 8 8. Conclusion: Payeer’s Potential Impact on Digital Payments in Bangladesh

- 9 8. Conclusion: Payeer’s Potential Impact on Digital Payments in Bangladesh

- 10 FAQ

1. Introduction to Payeer

1.1 What is Payeer?

Payeer is a digital payment platform that allows users to send, receive, and exchange various currencies, including cryptocurrencies. It offers a convenient solution for individuals and businesses to manage their online financial transactions securely.

1.2 Brief History of Payeer

Payeer was established in 2012 as a Russian-based payment system that quickly gained popularity worldwide. Over the years, it has expanded its services and now operates in more than 200 countries. With a user-friendly interface and a wide range of features, Payeer continues to attract users from different parts of the globe.

2. Overview of Digital Payment Services in Bangladesh

2.1 Digital Payment Landscape in Bangladesh

Bangladesh has experienced significant growth in digital payment services, driven by increasing internet penetration and smartphone usage. The country has witnessed a surge in the adoption of digital payment methods, with both individuals and businesses opting for more convenient and secure ways to transact.

2.2 Popular Digital Payment Services in Bangladesh

In Bangladesh, popular digital payment services include bKash, Nagad, Rocket, and SureCash. These platforms offer various features such as mobile wallet services, bill payments, fund transfers, and merchant payments. They have become integral to the financial ecosystem, providing convenient alternatives to traditional cash-based transactions.

3. Availability of Payeer in Bangladesh

3.1 Payeer’s Expansion into Bangladesh

Payeer has recently expanded its services into Bangladesh, offering its users in the country access to a wide range of digital payment solutions. With this expansion, Bangladeshis can now enjoy the benefits of Payeer’s global platform, making online transactions easier and more efficient.

3.2 Supported Currencies and Payment Methods in Bangladesh

Payeer in supports various currencies, including the U.S. Dollar (USD), Euro (EUR), and cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). Users can fund their Payeer accounts using local bank transfers, e-wallets, or through DollarPesa exchange services. This flexibility allows users in Bangladesh to transaction seamlessly in their preferred currency.

4. Benefits and Features of Payeer for Bangladeshi Users

4.1 Easy International Transactions with Payeer

Payeer provides Bangladeshi users with a simple and hassle-free solution for international transactions. Whether it’s sending money to family abroad or making online purchases from global merchants, Payeer offers a convenient way to transact internationally without the complexities of traditional banking systems.

4.2 Low Transaction Fees and Competitive Exchange Rates

One of the advantages of using Payeer in Bangladesh is its low transaction fees, making it a cost-effective option for individuals and businesses. Additionally, Payeer offers competitive exchange rates, ensuring that users get the most value out of their currency conversions.

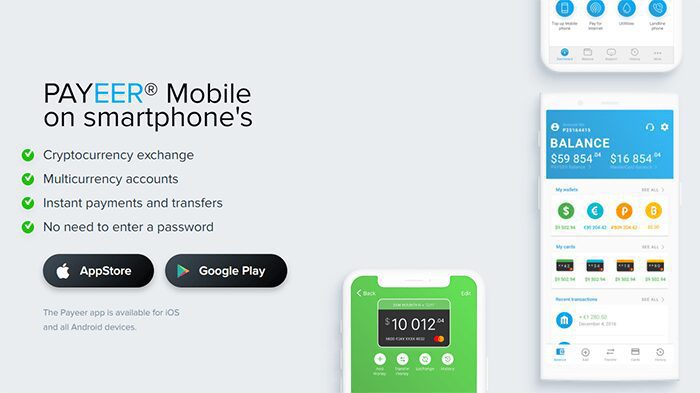

4.3 Accessibility and User-Friendly Interface

Payeer’s platform is designed to be user-friendly, even for individuals who may not be tech-savvy. The interface is intuitive and straightforward, allowing users in Bangladesh to navigate the platform easily. With accessibility in mind, Payeer ensures that its services are accessible via mobile devices, making transactions on-the-go convenient for its users.

In conclusion, Payeer’s expansion into Bangladesh brings a new and exciting digital payment option for individuals and businesses in the country. With its easy international transactions, low fees, and user-friendly interface, Payeer empowers Bangladeshis to embrace the benefits of digital payments in their daily lives.

5. How to Create a Payeer Account in Bangladesh

Creating a Payeer account in Bangladesh is as easy as pie! Just follow these simple steps and you’ll be up and running in no time.

5.1 Step-by-Step Guide to Setting Up a Payeer Account

Step 1: Visit the Payeer website and click on the “Sign Up” button. Don’t worry, it’s hard to miss!

Step 2: Fill in your personal details, such as your name, email address, and password. Make sure to choose a strong password to keep those cyber baddies at bay.

Step 3: Tick the box to agree to Payeer’s terms and conditions. Yes, it feels like signing your virtual soul away, but it’s necessary.

Step 4: Click on the “Create Account” button, and voila! You now have your very own Payeer account. Give yourself a pat on the back!

5.2 Verifying and Securing Your Payeer Account

Congratulations on creating your Payeer account! But wait, there’s more. You should take a few extra steps to verify and secure your account for added peace of mind.

To verify your account, simply provide Payeer with a copy of your ID document. They may also ask for additional documents depending on your account activity. Remember, don’t be shy when it comes to protecting your hard-earned money!

For extra security, enable two-factor authentication (2FA) in your account settings. This nifty feature adds an extra layer of protection by requiring an additional verification step whenever you log in. Those sneaky hackers won’t stand a chance!

6. Using Payeer for Online Transactions in Bangladesh

Now that you’ve got your shiny new Payeer account, it’s time to put it to good use! Here’s how you can make the most out of it for DollarPesa online transactions in Bangladesh.

6.1 Paying for Goods and Services Online with Payeer

Say goodbye to the hassle of typing in your credit card details every time you shop online. With Payeer, you can breeze through the checkout process by simply selecting it as your payment option. Easy peasy!

Not only is it convenient, but Payeer also offers a wide range of accepted merchants, so you’re bound to find your favorite online stores on their list. Time to indulge in some guilt-free online shopping!

6.2 Sending and Receiving Funds within Bangladesh

Need to split the restaurant bill with your buddies? Or maybe you want to send money to your family back home? Payeer’s got your back!

With Payeer, you can easily send and receive funds within Bangladesh. All you need is the recipient’s Payeer account number or email address. It’s like sending a virtual high-five, but with money!

7. Security and Privacy Considerations with Payeer in Bangladesh

We know security and privacy are hot topics these days, and rightfully so! Here’s what you need to know about Payeer’s security measures and commitment to protecting your precious data.

7.1 Payeer’s Security Measures and Fraud Prevention

Payeer takes security seriously. They use advanced encryption technology to keep your personal and financial information under lock and key. Plus, their fraud prevention tools are like a team of cyber ninjas ready to thwart any suspicious activity.

But remember, it’s a two-way street. You also play a crucial role in keeping your account secure. Don’t share your login details with anyone and always be cautious of phishing attempts. Stay vigilant, my friend!

7.2 Privacy Policies and Data Protection in Payeer

Your privacy matters, and Payeer knows it. They have strict privacy policies in place to ensure that your personal information is handled with care. They won’t sell your data to the highest bidder or bombard you with unwanted emails. It’s all about respecting your digital boundaries!

8. Conclusion: Payeer’s Potential Impact on Digital Payments in Bangladesh

In a world that’s becoming increasingly digital, Payeer opens up new possibilities for seamless online transactions in Bangladesh. With its user-friendly interface, wide acceptance among merchants, and commitment to security and privacy, Payeer has the potential to make waves in the digital payments scene.

So, whether you’re shopping online or sending money to loved ones, give Payeer a try and experience the convenience and simplicity it brings to the table. Happy transacting, folks!

8. Conclusion: Payeer’s Potential Impact on Digital Payments in Bangladesh

In conclusion, the availability of Payeer in Bangladesh presents a promising opportunity for individuals and businesses in the realm of digital payments. With its user-friendly interface, competitive fees, and international accessibility, Payeer offers a convenient and efficient platform for conducting online transactions. However, as with any digital payment service, it is crucial to prioritize security and privacy considerations to safeguard personal and financial information. As Payeer continues to expand and innovate, its potential impact on the digital payments landscape in Bangladesh is worth monitoring. By embracing technological advancements and fostering a secure environment, Payeer has the potential to play a significant role in shaping the future of digital transactions in Bangladesh.

FAQ

1. Is Payeer available for use in other countries besides Bangladesh?

Payeer is available for use in numerous countries around the world, including but not limited to Bangladesh. Its global presence allows users to transact internationally and access a wide range of digital payment services.

2. What are the fees associated with using Payeer in Bangladesh?

Payeer implements competitive fees for its services, including low transaction fees and competitive exchange rates. However, specific fee structures may vary depending on the nature of the transaction and currency conversion involved. It is advisable to review the fee schedule provided by Payeer for detailed information.

3. How secure is Payeer for online transactions in Bangladesh?

Payeer prioritizes the security of its users’ information and employs various measures to protect against fraud and unauthorized access. These include encryption protocols, two-factor authentication, and anti-fraud mechanisms. It is crucial for users to implement best practices, such as creating a strong password and regularly monitoring their account activity, to enhance the security of their Payeer transactions.

4. Can I use Payeer to transfer funds between different digital payment services in Bangladesh?

Payeer provides the flexibility to transfer funds between various digital payment services within Bangladesh, making it convenient for users to manage their finances across different platforms. This feature allows individuals to seamlessly navigate the digital payment landscape and access a wide range of services without limitations.