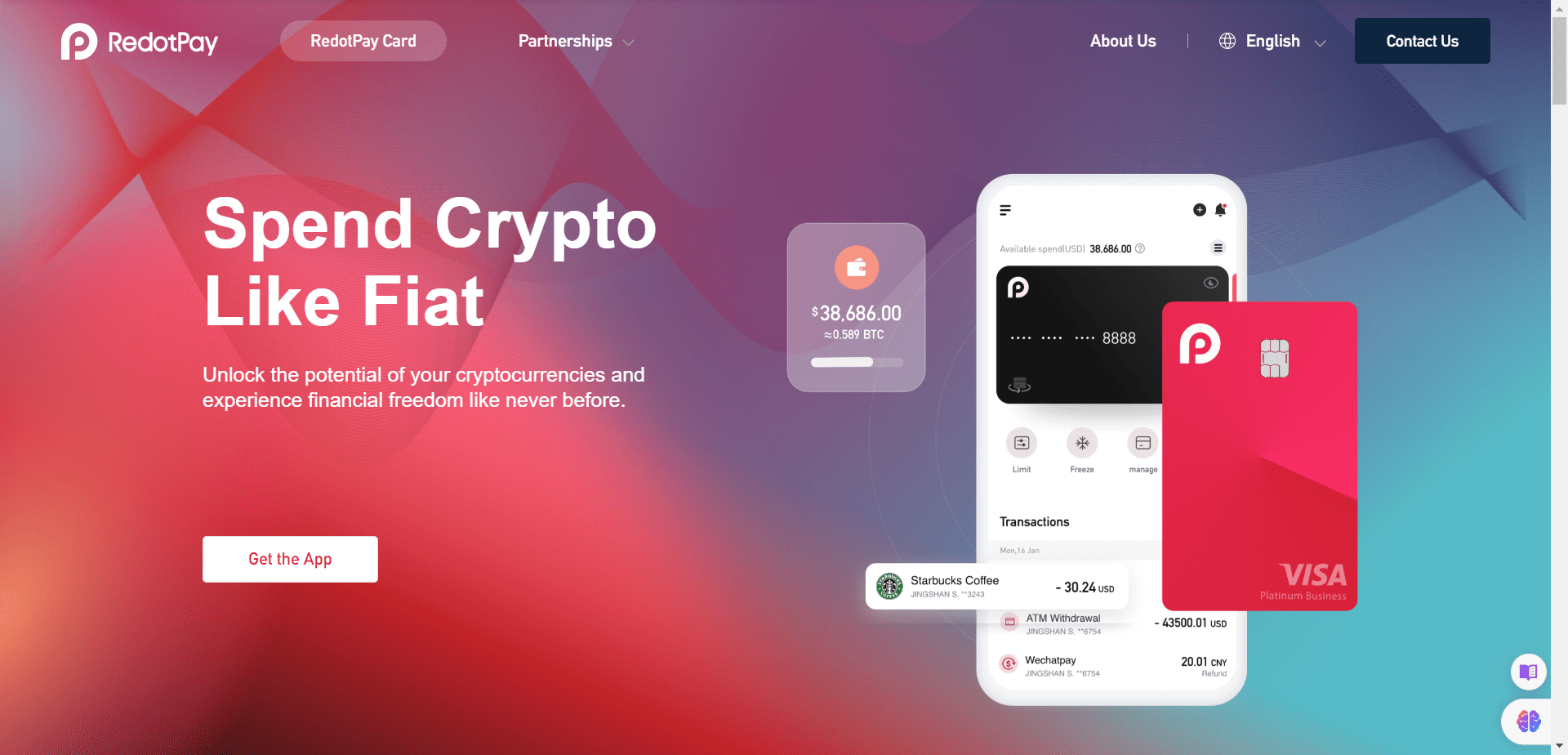

The convergence of traditional finance and cryptocurrency is a phenomenon we are witnessing with increasing frequency. Among the hybrid solutions leading this advancement is RedotPay, which offers a Visa card that integrates seamlessly with a crypto wallet. This amalgamation aims to simplify the spending of cryptocurrencies by enabling transactions at merchants accepting Visa while simultaneously providing a secure virtual wallet for storing and managing digital assets. The RedotPay Visa Card and Crypto Wallet are designed to bridge the gap between crypto and fiat currencies, catering to the growing demand for flexibility in managing one’s finances across both worlds. In the following article, we’ll delve into the intricacies of RedotPay’s offerings and explore how they stand out in the bustling market of crypto financial services.

Contents

Defining RedotPay Visa Card

The RedotPay Visa Card is a pioneering financial tool that allows users to spend their cryptocurrency holdings just as they would with a traditional debit or credit card. This innovative card converts your digital assets into fiat currency, enabling seamless transactions worldwide wherever Visa is accepted. This flexibility makes it an attractive option for crypto enthusiasts who want to use their investments for everyday purchases.

Functions of RedotPay Visa Card

Physical and Virtual Cards

The RedotPay ecosystem offers both physical and virtual Visa cards to cater to different user preferences. The physical card is ideal for those who prefer tangible transactions or need to withdraw cash from ATMs, while the virtual card facilitates online purchases and transactions without the need for a physical counterpart. Both card types are linked to the RedotPay Crypto Wallet, ensuring real-time conversion and spending of cryptocurrencies with ease.

Card Tiers and Perks

RedotPay Visa Card comes in various tiers, each providing a hierarchy of benefits and rewards. Users can choose a card tier based on their spending habits and desired perks, which may include cashback on purchases, higher withdrawal limits, and exclusive offers. The tiered system ensures that the card can cater to casual users as well as high-volume traders looking for premium benefits.

How to Use RedotPay Visa Card

Top-ups and Payments

Utilizing the RedotPay Visa Card is a straightforward process. Users can top up their cards using cryptocurrency from their RedotPay Crypto Wallet. Once the funds are loaded, the card can be used for payments just like any other Visa card. The conversion from crypto to fiat occurs instantly at the time of the transaction, simplifying the process for the end-user.

Security Features

Security stands as a cornerstone of RedotPay’s services. The Visa Card includes various security features such as two-factor authentication (2FA), real-time transaction alerts, and the ability to freeze the card through the app if it is lost or stolen. These measures provide peace of mind for users when carrying out transactions across the globe.

Exploring RedotPay Crypto Wallet

The RedotPay Crypto Wallet is an integral part of the service, designed to store, send, and receive a wide range of cryptocurrencies. It operates as a central hub for users’ digital assets, providing a secure environment for managing their investments.

The Role of Crypto Wallets

Crypto wallets are essential for anyone looking to operate within the digital currency space. They offer a secure digital storage solution for cryptocurrencies and give users the ability to execute transactions. RedotPay’s wallet is designed to integrate with its Visa Card, creating a streamlined experience for spending and managing crypto holdings.

Features of RedotPay’s Crypto Wallet

Supported Cryptocurrencies

One of the most significant features of RedotPay’s Crypto Wallet is the array of supported cryptocurrencies. Users can store popular coins like USDT, Bitcoin and Ethereum, as well as a selection of altcoins. This diversity allows for a broad user base with varied investment interests.

Transactions and Transfers

The wallet facilitates easy transactions and transfers, allowing users to send and receive crypto with minimal effort. The process is intuitive, with security features and a user-friendly interface that makes it accessible even to those new to the world of cryptocurrencies.

Security Protocols for RedotPay Crypto Wallet

Security is a paramount concern for any financial service, and RedotPay’s Crypto Wallet is no exception. It employs robust encryption and security protocols to protect users’ assets. Multi-signature wallets and regular security audits are part of the measures taken to ensure the safety of users’ funds.

How to Apply for RedotPay Visa Card and Crypto Wallet

Obtaining a RedotPay Visa Card and setting up a Crypto Wallet is a process designed to be as smooth and user-friendly as possible. Here’s what you need to know to get started and join the RedotPay ecosystem.

Eligibility Criteria

To apply for a RedotPay Visa Card and use the Crypto Wallet, prospective users must meet certain eligibility criteria. These usually include age and residency requirements, along with the need to pass identity verification checks. The aim is to comply with regulatory standards and ensure a secure financial environment for all users.

Application Process

Steps to Get RedotPay Visa Card

The first step to joining RedotPay is completing the application process. This typically involves filling out an online form, providing personal information, and going through a Know Your Customer (KYC) verification. Once approved, users can choose the tier of Visa Card they prefer and start enjoying the benefits of RedotPay.

Setting Up Crypto Wallet

Setting up the RedotPay Crypto Wallet is equally straightforward. After fulfilling the eligibility criteria and creating an account, users can secure their wallet, deposit cryptocurrencies, and link it to their Visa Card. The wallet’s design is focused on user-friendliness, ensuring a seamless onboarding process.

Efficacy of RedotPay Visa Card and Crypto Wallet in Crypto Payments

The integration of the RedotPay Visa Card with the Crypto Wallet represents a significant step forward in facilitating crypto payments. This system empowers users to spend their cryptocurrencies in a variety of settings, pushing the boundaries of digital currency use cases.

Benefits of Using Cryptocurrency for Payments

Cryptocurrency offers several advantages over traditional payment methods, including lower transaction fees, enhanced privacy, and more control over one’s assets. By using the RedotPay Visa Card, users can enjoy these benefits while still accessing the convenience and widespread acceptance of Visa’s network.

RedotPay’s Role in Facilitating Crypto Payments

RedotPay serves as a bridge between the cryptocurrency ecosystem and the mainstream financial system. Its Visa Card and Crypto Wallet simplify the process of using digital assets for everyday transactions, making it easier for merchants and customers alike to engage with cryptocurrency in a practical and efficient manner.

Comparing RedotPay with Other Crypto Cards and Wallets

In the competitive market of crypto financial services, RedotPay stands out with its unique offerings and commitment to user experience. However, it’s essential to consider how it stacks up against other options in the industry.

Unique Selling Points of RedotPay

RedotPay distinguishes itself through a combination of features, including instant crypto-to-fiat conversions, a tiered card system with tailored perks, and strong security measures. These attributes are designed to attract a diverse user base and make crypto spending as effortless as possible.

Pros and Cons of Using RedotPay

While RedotPay offers many advantages, such as ease of use and a rich feature set, potential drawbacks may include limited availability in certain regions and the need for users to navigate the volatility of cryptocurrency markets. As with any financial service, it’s crucial for users to weigh these factors against their personal needs and circumstances.

In summary, the RedotPay Visa Card and Crypto Wallet represent innovative solutions for individuals looking to integrate cryptocurrencies into their everyday financial activities. The user-friendly design, combined with robust security features and the ability to spend crypto as easily as fiat currency, positions RedotPay as a valuable player in the crypto finance space. As the landscape of digital payments continues to evolve, RedotPay’s offerings could pave the way for greater adoption of cryptocurrencies in everyday transactions, bridging the gap between the traditional and digital economies. Whether you are an experienced crypto trader or a newcomer to the world of digital currencies, RedotPay provides an accessible platform to manage and spend your assets with ease.