Payeer, a popular online payment system, offers users the convenience of a Payeer Master Card that can be used for various transactions. Whether it is making online purchases or withdrawing cash from ATMs, the Payeer Master Card provides flexibility and accessibility. However, like any financial service, it is essential to evaluate the fees and costs associated with the card to determine whether it is worth the investment. In this article, we will delve into a comprehensive comparison of Payeer Master Card fees, explore its benefits and features, consider alternatives, and analyze user experiences. By the end, you will have the information needed to assess if a Payeer Master Card is truly worth the cost.

Contents

- 1 1. Introduction to Payeer and its Master Card

- 2 2. Overview of Payeer Master Card fees and costs

- 3 3. Benefits and features of using Payeer Master Card

- 4 4. Alternatives to Payeer Master Card and their associated fees

- 5 5. Comparing the fees of Payeer Master Card with other payment options

- 6 6. Factors to consider before deciding on a Payeer Master Card

- 7 7. User experiences and feedback on using Payeer Master Card

- 8 8. Conclusion: Is a Payeer Master Card worth the cost?

- 9 8. Conclusion: Is a Payeer Master Card worth the cost?

- 10 FAQ

1. Introduction to Payeer and its Master Card

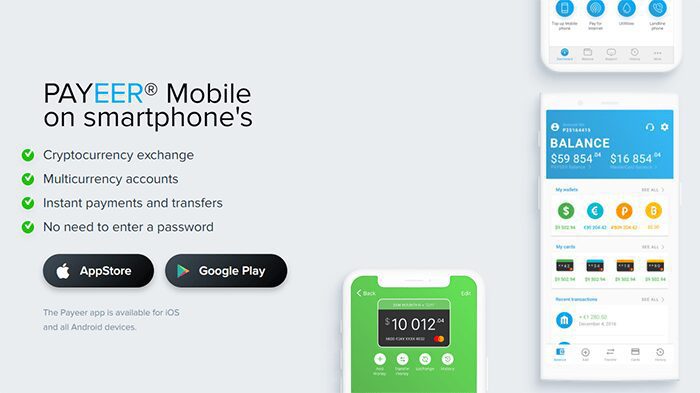

1.1 What is Payeer?

Payeer is an e-wallet service that allows users to make online payments and transfer funds electronically. It offers a range of features and services, including the ability to send and receive money, exchange currencies, and even withdraw funds to a physical Master Card.

1.2 What is Payeer Master Card?

The Payeer Master Card is a physical payment card that is linked to your Payeer e-wallet. It allows you to access your funds and make purchases in both online and offline stores. The card is accepted worldwide at any retailer that accepts Master Card, making it a convenient option for those who frequently travel or shop internationally.

2. Overview of Payeer Master Card fees and costs

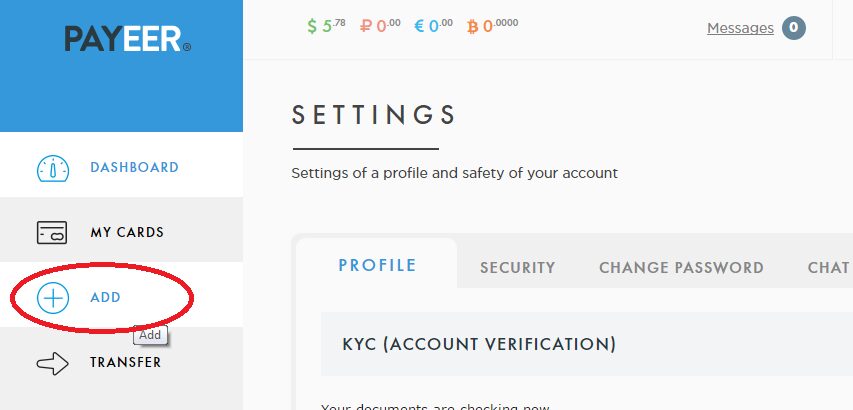

2.1 Activation fees

To get started with the Payeer Master Card, there is an activation fee that needs to be paid. This fee may vary depending on your location and the service provider you choose. However, it is important to consider this cost when deciding whether the card is worth it for you.

2.2 Monthly/annual maintenance fees

In addition to the activation fee, there may be monthly or annual maintenance fees associated with the Payeer Master Card. These fees are charged to keep your card active and usable. It’s essential to understand these costs to determine if the card is a cost-effective solution for your financial needs.

2.3 Transaction fees

Each time you use your Payeer Master Card for a transaction, there may be transaction fees involved. These fees can vary depending on the type of transaction, such as online purchases or in-store payments. It’s crucial to be aware of these fees to avoid any surprise charges.

2.4 ATM withdrawal fees

If you plan on using the Payeer Master Card to withdraw cash at ATMs, there may be additional fees for these transactions. These fees can vary depending on the ATM network you use and the location of the ATM. Considering these fees is important if you rely on cash withdrawals for your everyday expenses.

2.5 Currency conversion fees

If you make purchases or withdrawals in a currency different from the one in your Payeer e-wallet, there may be currency conversion fees. These fees can add up, especially for frequent travelers or individuals who frequently make cross-border transactions. Understanding these fees can help you make informed decisions about your payment options.

3. Benefits and features of using Payeer Master Card

3.1 Worldwide acceptance

One of the significant benefits of the Payeer Master Card is its worldwide acceptance. With Master Card’s extensive network, you can use your card to make payments at millions of locations globally, making it a convenient choice for international travelers.

3.2 Multiple currency support

Payeer Master Card supports multiple currencies, allowing you to make transactions in various currencies without the need for manual currency conversion. This feature can be particularly useful if you frequently deal with different currencies in your day-to-day finances.

3.3 Online and offline usability

Whether you’re shopping online or making purchases at your favorite local store, the Payeer Master Card can be used for both online and offline transactions. This versatility ensures that you can use your card wherever and whenever you need it.

3.4 Card features and customization options

Payeer Master Card comes with various features and customization options. You can personalize your card design, set spending limits, and even receive real-time transaction notifications. These features enhance your control and convenience when using the card.

4. Alternatives to Payeer Master Card and their associated fees

4.1 Alternative payment cards

If the fees associated with Payeer Master Card are not appealing to you, there are alternative payment cards available in the market that offer different fee structures. It’s worth exploring these alternatives to find a card that aligns better with your financial needs.

4.2 E-wallet options

Aside from Payeer, there are other e-wallet options available that offer similar services. These e-wallets may have different fee structures and features, so comparing them can help you determine the best choice for your financial transactions.

4.3 Cryptocurrency-based payment solutions

For those interested in innovative and decentralized payment solutions, cryptocurrency-based payment options can be an alternative to traditional payment cards. These solutions often come with their own unique fee structures, so it’s essential to research and understand how they differ from traditional payment methods.

5. Comparing the fees of Payeer Master Card with other payment options

5.1 Fee comparison chart

When it comes to fees, it’s important to compare different payment options to see which one suits your needs and budget. Here’s a handy chart to help you understand the fees associated with a Payeer Master Card and how they stack up against other payment options:

| Payment Option | Card Issuing Fee | Annual Fee | ATM Withdrawal Fee | Currency Conversion Fee |

| Payeer Master Card | $10.00 | $15.00 | $3.50 | 4% |

| Pyypl Visa Card | $5.00 | $5.00 | $3.00 | 3% |

| Redotpay Visa Card | $10.00 | $10.00 | $1.20 | 1.20% |

| Perfect Money Card | $49.00 | $49.00 | $1.20 | 1.25 % |

| Advcash Card | $19.95 | $19.95 | $2.99 | 2.95%. |

5.2 Analysis of cost-effectiveness

Now, let’s break down the cost-effectiveness of the Payeer Master Card compared to other payment options. While the Payeer Master Card has a slightly higher card issuing fee and annual fee, it offers competitive rates for ATM withdrawals and currency conversion. If you frequently travel internationally or make online purchases in different currencies, the 4% currency conversion fee may be worth it for the convenience and flexibility the Payeer Master Card provides. However, if you rarely use ATMs or make international transactions, you may find other payment options with lower fees more cost-effective.

6. Factors to consider before deciding on a Payeer Master Card

6.1 Personal spending habits

Before applying for a Payeer Master Card, consider your personal spending habits. Do you often make purchases online or in foreign currencies? Do you frequently withdraw cash from ATMs? Understanding your spending patterns will help you determine if the features and fees of the Payeer Master Card align with your needs.

6.2 Frequency of international transactions

If you frequently make international transactions, the Payeer Master Card’s currency conversion fee becomes a crucial factor to consider. Compare it with other payment options to ensure you’re getting the best value for your money.

6.3 Available customer support

When dealing with financial matters, having reliable customer support is vital. Research the customer support services offered by Payeer and make sure they are easily accessible and responsive to address any concerns or issues that may arise.

6.4 Security measures

The security of your funds and personal information should be a priority. Look into the security measures implemented by Payeer, such as two-factor authentication and encryption, to ensure your financial transactions are protected from unauthorized access.

7. User experiences and feedback on using Payeer Master Card

7.1 Positive user experiences

Many users have reported positive experiences using the Payeer Master Card. They appreciate the convenience of accessing their funds globally, the ease of making online purchases, and the ability to withdraw cash from ATMs worldwide. The quick and efficient customer support has also received praise from satisfied users.

7.2 Negative user experiences

Some users have expressed dissatisfaction with the fees associated with the Payeer Master Card, particularly the currency conversion fee. Additionally, a few users have encountered difficulties in reaching customer support for assistance, which has led to frustrations.

8. Conclusion: Is a Payeer Master Card worth the cost?

Considering the fees, personal spending habits, frequency of international transactions, customer support, and security measures, deciding if a Payeer Master Card is worth the cost ultimately depends on your individual needs and preferences. If you frequently make international transactions and value the convenience of a global payment card, the Payeer Master Card may be a suitable choice. However, if you have minimal international transactions or are looking for lower fees, exploring alternative payment options could be more cost-effective. Remember to weigh the pros and cons before making a decision that aligns with your financial goals and lifestyle.

8. Conclusion: Is a Payeer Master Card worth the cost?

After considering the fees, benefits, and alternatives, it becomes clear that the value of a Payeer Master Card depends on individual circumstances and preferences. For frequent international travelers or individuals who frequently make online purchases, the convenience and worldwide acceptance of the card may outweigh the associated fees. However, for those who have access to alternative payment options with lower costs or have specific security concerns, exploring other alternatives might be a more suitable choice. Ultimately, it is crucial to carefully evaluate personal spending habits and requirements before deciding whether a Payeer Master Card is worth the cost.

FAQ

1. Can I use the Payeer Master Card for online purchases?

Yes, the Payeer Master Card is widely accepted for online purchases, making it a convenient option for shopping on various websites and platforms.

2. Are there any additional fees for international transactions?

Yes, Payeer Master Card charges a currency conversion fee for international transactions. It is important to consider this fee, especially if you frequently make purchases in different currencies.

3. Can I withdraw cash from ATMs using the Payeer Master Card?

Yes, the Payeer Master Card allows you to withdraw cash from ATMs worldwide. However, keep in mind that there may be withdrawal fees associated with using the card at ATMs, which should be taken into account when evaluating the overall cost.

4. How can I contact customer support regarding any issues or concerns?

Payeer provides customer support services for their users. You can reach out to their customer support team through their website or by contacting them directly via email or phone. It is recommended to check their official website for the most up-to-date contact information.