Payeer is a convenient and secure online payment system that allows individuals and businesses to manage their money and make transactions easily. Whether you need to send or receive funds, pay for online purchases, or transfer money to friends and family, Payeer offers a range of features and benefits to meet your financial needs. In this article, we will provide you with a step-by-step guide on how to create a Payeer account, explore its various features and benefits, and offer valuable tips to ensure the security and efficient management of your account. If you’re looking for a reliable and versatile payment solution, Payeer might be just what you need.

Contents

1. Introduction to Payeer

1.1 What is Payeer?

Payeer is a digital payment platform that allows you to send, receive, and exchange money with just a few clicks. Whether you need to pay for online purchases, send money to friends and family, or even receive payments as a freelancer, Payeer provides a convenient and secure solution.

1.2 Benefits of Using Payeer

Using Payeer comes with a range of benefits that make it a popular choice for individuals and businesses worldwide. First and foremost, it offers a wide variety of supported currencies, making it easy to manage your funds in your preferred currency. Additionally, Payeer boasts quick and seamless transactions, low fees, and a user-friendly interface, making it accessible to both beginners and experienced users alike.

2. Step-by-step Guide to Creating a Payeer Account

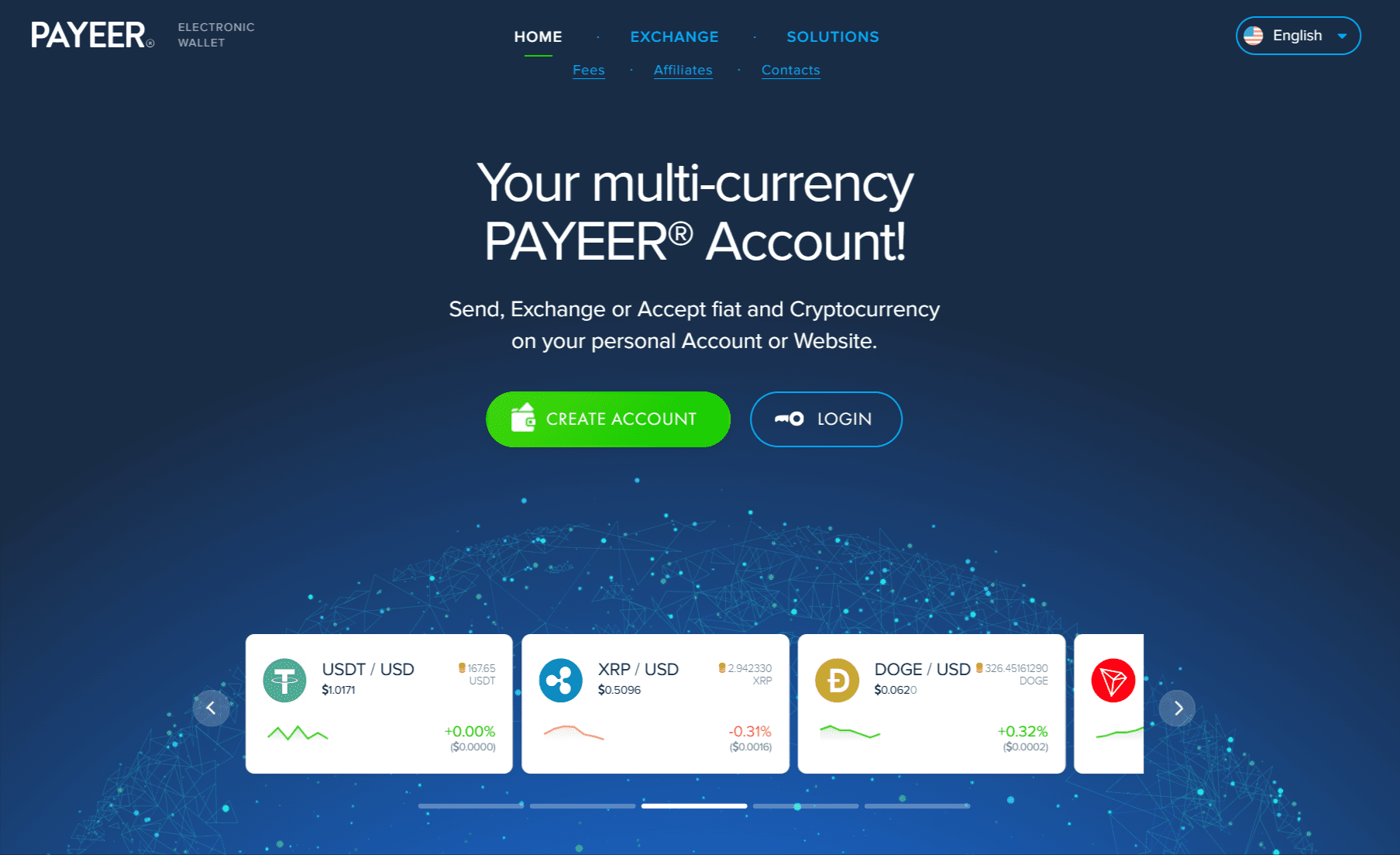

2.1 Accessing the Payeer Website

To create a Payeer account, start by visiting the official Payeer website. Simply open your preferred web browser and enter “Payeer” in the search bar. Click on the official website link in the search results to access the Payeer homepage.

2.2 Selecting the Sign-Up Option

Once on the Payeer homepage, look for the “Sign Up” or “Create Account” button. Click on it to begin the account creation process.

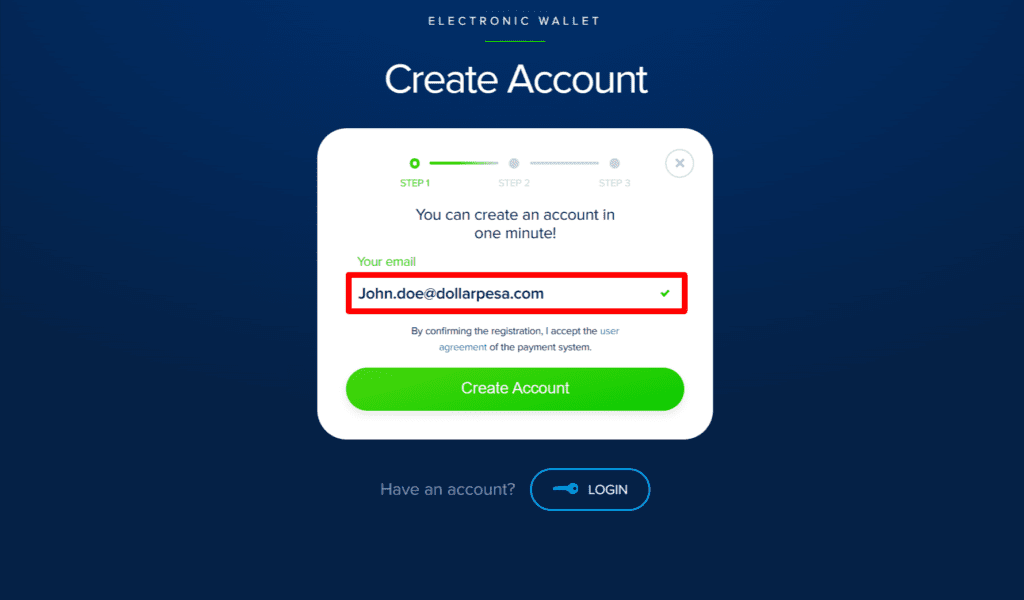

2.3 Providing Personal Information

To proceed with the account creation, you will need to provide some personal information, such as your email address, country of residence, and preferred account currency. Make sure to double-check the accuracy of the information before proceeding.

2.4 Verifying Email and Phone Number

After providing your personal information, Payeer will send a verification link to the email address you provided. Click on the link to verify your email. Additionally, you will receive a verification code on your phone via SMS. Enter the code in the designated field to verify your phone number.

2.5 Setting Up Password and Security Measures

Next, you will be prompted to create a password for your Payeer account. Make sure to choose a strong and unique password that is not easily guessable. Payeer may also offer additional security measures, such as two-factor authentication (2FA), which we highly recommend enabling for enhanced account security.

2.6 Completing the Account Creation Process

Once you have set up your password and any other security measures, review the provided information to ensure accuracy. If everything looks correct, click on the “Create Account” or “Finish” button to complete the account creation process. Congratulations, you now have a Payeer account!

3. Understanding Payeer Account Features and Benefits

3.1 Account Types and Levels

Payeer offers different account types and levels, each with varying limits and features. These levels determine the transaction limits, account verification requirements, and access to additional services. Make sure to familiarize yourself with the different account types to choose the one that best suits your needs.

3.2 Supported Currencies

One of the major advantages of Payeer is its extensive list of supported currencies. From popular fiat currencies like USD and EUR to various cryptocurrencies, you can easily manage funds in multiple currencies within your Payeer account.

3.3 Transaction Limits and Fees

Payeer imposes certain transaction limits and fees for different types of transactions. These limits and fees may vary depending on factors such as your account level, transaction history, and the payment method used. It is essential to understand these limits and fees to effectively manage your transactions on the platform.

3.4 Integration with Online Merchants

Payeer provides integration options for online merchants, allowing them to accept payments through the platform. This integration makes it convenient for businesses to receive payments from customers using Payeer, expanding their payment options and reaching a wider audience.

4. How to Verify and Secure Your Payeer Account

4.1 Verifying Your Identity

To enhance the security and functionality of your Payeer account, it is recommended to undergo the identity verification process. This may require providing additional personal details and supporting documents to confirm your identity. Verifying your identity helps protect your account from unauthorized access and ensures compliance with regulatory requirements.

4.2 Two-Factor Authentication (2FA)

Enabling two-factor authentication (2FA) adds an extra layer of security to your Payeer account. By linking your account with a mobile app or receiving authentication codes via SMS, you can prevent unauthorized access even if someone obtains your password. It’s a simple yet effective way to protect your funds and personal information.

4.3 Additional Security Measures

In addition to 2FA, Payeer may offer additional security measures such as transaction PIN codes or security questions. Take advantage of these features to further secure your account. Regularly updating and strengthening your passwords, being cautious of phishing attempts, and avoiding sharing sensitive account information are also crucial steps in keeping your Payeer account secure. Remember, your account security is in your hands!Funding and Withdrawing Money from Your Payeer Account

Adding Funds to Your Payeer Account

To add funds to your Payeer account, simply follow these easy steps:

1. Log in to your Payeer account.

2. Navigate to the “Add Funds” section.

3. Choose your preferred payment method from the available options.

4. Enter the amount you wish to add to your account.

5. Confirm the transaction details and proceed with the payment.

6. Once the payment is successful, the funds will be instantly available in your Payeer account.

Withdrawing Money from Your Payeer Account

When it’s time to withdraw money from your Payeer account, here’s what you need to do:

1. Sign in to your Payeer account.

2. Go to the “Withdraw” section.

3. Select your desired withdrawal method from the provided options.

4. Enter the amount you want to withdraw.

5. Review the transaction details and confirm the withdrawal request.

6. The funds will be processed and transferred to your chosen withdrawal method according to the specified timeline.

Supported Payment Methods

Payeer offers a wide range of payment methods to make funding and withdrawing money from your account easy and convenient. Some of the supported payment methods include:

– Bank transfers

– Credit and debit cards

– Electronic money systems (such as PayPal and WebMoney)

– Cryptocurrencies (Bitcoin, Ethereum, and more)

Exploring Additional Services and Integration Options with Payeer

Payeer Merchant Solution

For businesses and online merchants, Payeer provides a Merchant Solution that allows seamless integration of payment processing into their websites or platforms. With Payeer Merchant Solution, you can accept payments from customers around the world, opening up new opportunities for your business.

Payeer API Integration

If you’re a developer or have technical expertise, Payeer offers an API that allows you to integrate Payeer services directly into your own applications or websites. This integration can enhance the functionality of your platform and provide a smoother payment experience for your users.

Frequently Asked Questions about Payeer Account Creation

What documents are required for account verification?

To verify your Payeer account, you will usually need to provide a copy of your ID or passport, proof of address (such as a utility bill or bank statement), and sometimes additional documents depending on your country of residence and the level of verification required.

How long does it take to verify a Payeer account?

The verification process for a Payeer account can vary depending on several factors, including the completeness and accuracy of the documents provided. Typically, the verification process takes anywhere from a few hours to a few days. It is recommended to ensure all required documents are submitted correctly to avoid delays.

Are there any transaction limits for newly created accounts?

Yes, newly created Payeer accounts may have certain transaction limits in place, especially for withdrawals. These limits are typically in place to ensure the security and integrity of the platform. However, the specific limits may vary depending on various factors, including the level of account verification and the chosen payment method. It’s always best to check the Payeer website or contact their customer support for the most up-to-date information.

Tips and Best Practices for Managing Your Payeer Account

Keeping your Payeer account secure and managing it effectively is essential. Here are some tips and best practices to help you make the most of your Payeer account:

1. Enable two-factor authentication (2FA) for an extra layer of security.

2. Keep your login credentials confidential and avoid sharing them with others.

3. Regularly monitor your account activity and report any suspicious transactions or activities to Payeer.

4. Keep your contact information up to date to ensure you receive important account notifications.

5. Familiarize yourself with Payeer’s terms and conditions to understand the rules and regulations governing your account.

By following these tips, you can have a smooth and secure experience while managing your Payeer account. Happy banking!In conclusion, creating a Payeer account opens up a world of convenient and secure financial transactions. With its easy-to-follow account creation process, robust security features, and various integration options, Payeer provides individuals and businesses with a reliable platform to manage their money effectively. By following the step-by-step guide outlined in this article and implementing best practices for account management, you can confidently utilize Payeer for your online payments, transfers, and more. Start your Payeer journey today and experience the convenience and versatility it brings to your financial transactions.

7. Frequently Asked Questions about Payeer Account Creation

1. What is Payeer?

Payeer is an online payment system that allows users to send and receive money, make online purchases, and exchange cryptocurrencies. It supports a wide range of payment methods and currencies, making it a convenient option for users around the world.

You can find more information about Payeer on their official website: https://payeer.com/

2. How do I create a Payeer account?

Creating a Payeer account is easy. Simply visit the Payeer website and click on the “Sign Up” button. Follow the step-by-step account creation process, which includes providing your personal information and setting up security features.

3. Is Payeer secure?

Yes, Payeer takes security seriously. The platform utilizes robust security features, such as two-factor authentication, to ensure the safety of your account and transactions.

4. Can I integrate Payeer with other platforms?

Yes, Payeer provides various integration options. You can integrate Payeer with e-commerce websites, online stores, and other platforms to accept payments and manage your finances seamlessly.

5. What can I use Payeer for?

Payeer can be used for a wide range of financial transactions. You can use it to make online payments, send and receive money, exchange currencies, and even withdraw funds to your bank account.

6. Are there any fees associated with using Payeer?

Yes, Payeer charges fees for certain transactions, such as currency exchanges and withdrawals. The fees vary depending on the type of transaction and the currency involved. You can find detailed information about the fees on the Payeer website.

7. How can I contact Payeer customer support?

If you have any questions or need assistance, you can contact Payeer customer support through the “Support” section on their website. They provide email support and also have a ticket option for immediate assistance.

8. Can I use Payeer internationally?

Yes, Payeer can be used internationally. It supports multiple currencies and allows you to send and receive money from users all around the world.

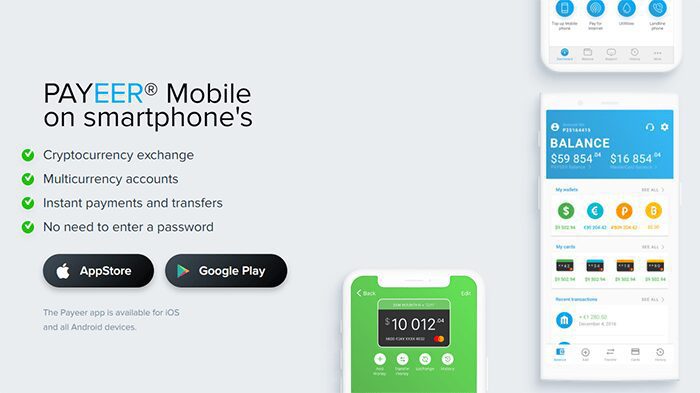

9. Is there a mobile app for Payeer?

Yes, Payeer has a mobile app available for both iOS and Android devices. You can download the app from the App Store or Google Play Store to access your Payeer account on the go.

10. How can I ensure a smooth and secure experience while using Payeer?

To have a smooth and secure experience with Payeer, it is recommended to follow these tips: – Enable two-factor authentication for added security. – Keep your account information and login credentials confidential. – Regularly update your password and avoid using easily guessable passwords. – Be cautious of phishing attempts and only use official Payeer platforms and apps. – Monitor your account activity regularly and report any suspicious transactions to Payeer customer support.

We hope this FAQ provides you with the necessary information to have a smooth and secure experience while managing your Payeer account. Happy banking!