Digital currency exchange has emerged as a pivotal component of the ever-evolving world of cryptocurrency. As cryptocurrencies gain popularity and mainstream acceptance, the need for reliable and efficient platforms to buy, sell, and trade these digital assets has become increasingly crucial. This article explores the concept of digital currency exchange, delving into its functionality, benefits, and risks. It also analyzes different types of digital currency exchanges available in the market, factors to consider when choosing a platform, security measures, and regulations.

Additionally, the article offers valuable tips for successful trading and provides insights into the future of digital currency exchanges, including emerging trends and challenges. Whether you are a seasoned cryptocurrency enthusiast or a curious newcomer, this article aims to provide a comprehensive understanding of digital currency exchange.

Contents

- 1 What Is a Digital Currency Exchange and How Does It Work?

- 2 1. Introduction to Digital Currency Exchange

- 3 2. Understanding the Functionality of Digital Currency Exchange Platforms

- 4 3. Benefits and Risks of Engaging in Digital Currency Exchange

- 5 4. Exploring Different Types of Digital Currency Exchanges

- 6 5. Factors to Consider When Choosing a Digital Currency Exchange

- 7 6. Security Measures and Regulations in Digital Currency Exchange

- 8 7. Tips for Successful Trading on Digital Currency Exchanges

- 9 8. The Future of Digital Currency Exchanges: Emerging Trends and Challenges

- 10 FAQ

What Is a Digital Currency Exchange and How Does It Work?

1. Introduction to Digital Currency Exchange

1.1 What is a Digital Currency Exchange?

A digital currency exchange is a platform that allows individuals to buy, sell, and trade various cryptocurrencies. Essentially, it’s like a stock market for digital currencies. These exchanges provide a convenient and secure way for users to enter the world of cryptocurrencies and manage their digital assets.

1.2 Brief History of Digital Currency Exchanges

Digital currency exchanges have come a long way since the inception of the first cryptocurrency, Bitcoin, in 2009. Initially, exchanges were limited and often faced issues with security and regulation. However, over time, as cryptocurrencies gained more popularity, the number of exchanges increased, offering a wider range of services and improving security measures. Today, digital currency exchanges play a vital role in facilitating the global cryptocurrency market.

2. Understanding the Functionality of Digital Currency Exchange Platforms

2.1 How Digital Currency Exchanges Work

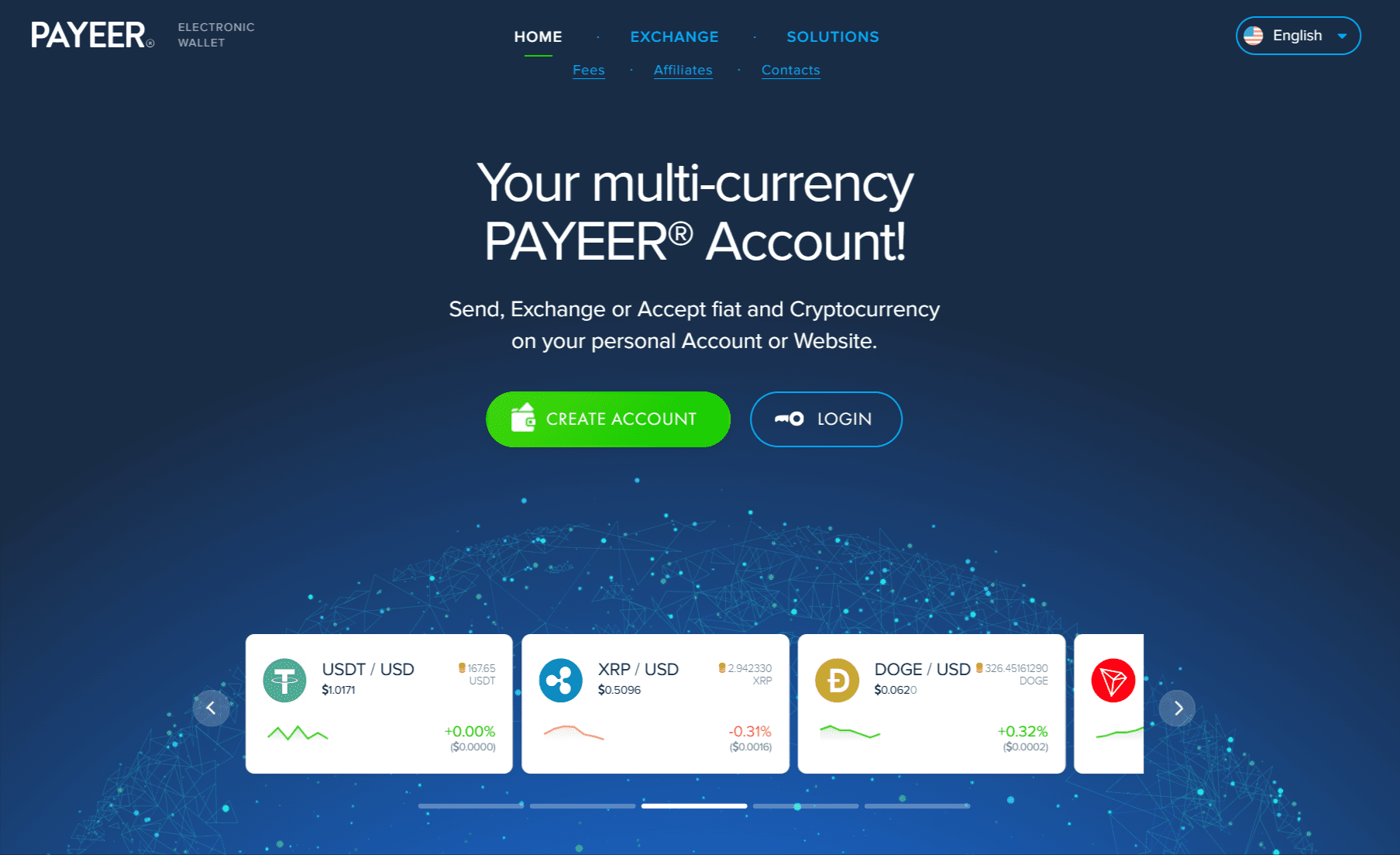

Digital currency exchanges work as online platforms where users can create accounts, deposit funds, and start trading cryptocurrencies. Once an account is set up, users can place buy or sell orders for specific cryptocurrencies and execute trades based on the current market prices. These platforms usually charge a transaction fee for their services.

2.2 Key Features and Services Offered by Digital Currency Exchange Platforms

Digital currency exchange platforms offer a range of features and services to enhance the trading experience. These may include real-time price charts, order books, and trade history to keep users informed about market trends. They also provide wallet services for storing cryptocurrencies securely, and some even offer advanced trading options like margin trading and futures contracts.

3. Benefits and Risks of Engaging in Digital Currency Exchange

3.1 Advantages of Using Digital Currency Exchanges

One of the significant advantages of using digital currency exchanges is the accessibility they provide to the cryptocurrency market. These platforms allow users to easily buy, sell, and trade cryptocurrencies with just a few clicks, making it convenient for newcomers and experienced traders alike. Additionally, digital currency exchanges often have high liquidity, meaning users can quickly convert their cryptocurrencies into fiat currencies or other digital assets.

3.2 Potential Risks and Challenges in Digital Currency Exchange

While digital currency exchanges offer many benefits, it’s important to be aware of the potential risks involved. Security is a significant concern as exchanges can be vulnerable to hacking attacks, resulting in the loss of funds. Moreover, the volatility of cryptocurrencies themselves poses risks, as the value of digital assets can fluctuate dramatically. Regulatory uncertainties and lack of industry standards can also make the digital currency exchange landscape somewhat unpredictable.

4. Exploring Different Types of Digital Currency Exchanges

4.1 Centralized Digital Currency Exchanges

Centralized exchanges are the most common type and operate as intermediaries between buyers and sellers. These exchanges hold users’ funds on their platforms, providing liquidity and facilitating trades. While centralized exchanges offer convenience and ease of use, they also face criticism for their potential vulnerability to hacking or insider manipulation.

4.2 Decentralized Digital Currency Exchanges

Decentralized exchanges (DEXs) operate on blockchain technology, eliminating the need for intermediaries. These exchanges allow users to trade directly with each other using smart contracts, ensuring transparency and security. DEXs provide more control over funds but may have lower liquidity and limited trading options compared to centralized exchanges.

4.3 Peer-to-Peer Digital Currency Exchanges

Peer-to-Peer (P2P) exchanges connect buyers and sellers directly, allowing them to trade cryptocurrencies without intermediaries. These exchanges offer privacy and often have a wider range of payment methods available. However, P2P exchanges can involve higher risks of fraud or disputes, requiring users to exercise caution when engaging in transactions.

In conclusion, digital currency exchanges provide a gateway into the world of cryptocurrencies, offering features and services that make trading accessible to a broader audience. While they come with their benefits and risks, understanding how these exchanges work and the different types available can help individuals navigate this exciting and evolving landscape with confidence.

5. Factors to Consider When Choosing a Digital Currency Exchange

5.1 Security Measures and Safeguards

When it comes to digital currency exchanges, security should be your top priority. Look for exchanges that employ robust security measures such as encryption, two-factor authentication, and cold storage for your funds. You want to make sure your hard-earned cryptocurrencies are protected from hackers and other digital miscreants.

5.2 Supported Cryptocurrencies and Trading Pairs

Not all digital currency exchanges support the same cryptocurrencies. Make sure the exchange you choose supports the cryptocurrencies you want to trade. Additionally, check if they offer a variety of trading pairs, allowing you to easily exchange your digital assets.

5.3 User Interface and Experience

Trading on a digital currency exchange should be a breeze, not a headache-inducing experience. Look for exchanges with user-friendly interfaces that make it easy to navigate and execute trades. After all, you don’t want to waste valuable time figuring out how to buy or sell your cryptocurrencies.

5.4 Liquidity and Trading Volume

Liquidity and trading volume are crucial factors to consider when choosing a digital currency exchange. Higher liquidity means there are more buyers and sellers on the platform, making it easier to find a match for your trades. Additionally, higher trading volume indicates a more active and vibrant marketplace.

6. Security Measures and Regulations in Digital Currency Exchange

6.1 Security Protocols and Measures

Digital currency exchanges employ various security protocols to safeguard your funds. These can include secure servers, encryption, and advanced authentication methods. Look for exchanges that prioritize security and have a track record of keeping their users’ assets safe.

6.2 Compliance and Regulatory Frameworks

Regulations surrounding digital currency exchanges vary across jurisdictions. It’s important to choose an exchange that complies with relevant regulations and has proper licensing. This helps ensure the exchange operates ethically and provides a legal and regulated trading environment for users.

7. Tips for Successful Trading on Digital Currency Exchanges

7.1 Setting Realistic Goals and Strategies

Trading cryptocurrencies can be exciting but also volatile. Set realistic goals and develop strategies that align with your risk tolerance and investment objectives. Don’t get caught up in the hype and make impulsive decisions that could lead to financial regrets.

7.2 Performing Thorough Research and Analysis

Before making any trades, conduct thorough research and analysis. Keep an eye on market trends, news, and the overall sentiment surrounding cryptocurrencies. This will help you make informed trading decisions and minimize the chances of falling into FOMO (Fear of Missing Out) traps.

7.3 Managing Risk and Utilizing Risk Management Tools

Risk management is crucial in any form of trading. Set stop-loss orders to limit potential losses, diversify your portfolio, and use risk management tools provided by the exchange. Remember, trading is a marathon, not a sprint, so it’s essential to protect your capital and manage risk effectively.

8. The Future of Digital Currency Exchanges: Emerging Trends and Challenges

8.1 Integration of Artificial Intelligence and Machine Learning

As technology continues to advance, digital currency exchanges are exploring the integration of artificial intelligence and machine learning. These technologies can help improve trading strategies, enhance security measures, and provide users with personalized trading experiences.

8.2 Regulatory Developments and Global Adoption

Regulatory developments play a significant role in shaping the future of digital currency exchanges. As governments worldwide establish clearer guidelines, it is expected that the industry will witness increased adoption and mainstream acceptance, paving the way for a more mature and stable trading environment.

8.3 Scalability and Handling Increasing User Demand

As more people enter the world of digital currencies, exchanges face the challenge of handling increasing user demand. Scalability becomes crucial in ensuring smooth operations and avoiding technical glitches during peak trading periods. Exchanges will need to invest in robust infrastructure to handle the growing number of users while maintaining quality service.In conclusion, digital currency exchange plays a pivotal role in the world of cryptocurrencies, enabling users to engage in buying, selling, and trading digital assets with ease.

While the benefits are evident, it is crucial to remain mindful of the potential risks and challenges associated with this rapidly evolving industry. By staying informed, conducting thorough research, and choosing reputable platforms, individuals can navigate the digital currency exchange landscape with confidence. As the future unfolds, embracing emerging trends and adapting to regulatory developments will be key to the continued growth and success of digital currency exchanges. With diligence and a solid understanding of the intricacies involved, individuals can harness the potential of digital currencies and seize opportunities in this exciting realm of finance.

FAQ

1. What is a digital currency exchange?

A digital currency exchange is a platform that allows users to buy, sell, and trade various cryptocurrencies. It acts as an intermediary, facilitating transactions between buyers and sellers of digital assets.

2. Are digital currency exchanges secure?

Digital currency exchanges employ various security measures to protect users’ funds and personal information. These may include encryption, two-factor authentication, cold storage for funds, and regular security audits. However, it is essential for users to choose reputable and well-established exchanges and take additional precautions to ensure the security of their assets.

3. How do I choose the right digital currency exchange?

Choosing the right digital currency exchange depends on several factors. Consider aspects such as security measures, supported cryptocurrencies, trading volume, user interface, fees, and regulatory compliance. It is recommended to research and compare different exchanges to find one that aligns with your needs and priorities.

4. Can I make profits by trading on digital currency exchanges?

Trading on digital currency exchanges can potentially generate profits, but it also carries risks. Success in trading requires knowledge, strategy, and market analysis. It is crucial to understand the volatility and risks associated with cryptocurrencies and to approach trading with caution and a realistic minds