Wire transfers are a widely used method of electronic funds transfer that allows individuals and businesses to send money securely and quickly to recipients around the world. This article aims to provide a comprehensive understanding of wire transfers, including how they work, their benefits, fees and charges associated with them, and important considerations before initiating a transfer. Additionally, we will explore the security measures in place to protect wire transfers and discuss some alternatives that are available for financial transactions. Whether you are new to wire transfers or looking to deepen your knowledge, this article will serve as a valuable resource.

Contents

- 1 1. Introduction to Wire Transfers

- 2 2. How Wire Transfers Work

- 3 3. Benefits and Advantages of Wire Transfers

- 4 4. Factors to Consider before Initiating a Wire Transfer

- 5 5. Common Fees and Charges Associated with Wire Transfers

- 6 6. Security and Safety Measures for Wire Transfers

- 7 7. Alternatives to Wire Transfers

- 8 8. Conclusion and Final Thoughts

- 9 8. Conclusion and Final Thoughts

- 10 FAQ

1. Introduction to Wire Transfers

Definition and Overview

So you’ve heard the term “wire transfer” thrown around, but what exactly does it mean? Well, my friend, a wire transfer is a way to electronically transfer money from one person or organization to another. It’s like sending a cash-filled envelope, but without the risk of it getting lost in the mail or stolen by a sneaky squirrel.

Historical Background

Wire transfers have been around for quite some time. In fact, they date back to the days when people communicated by telegraph. Can you imagine sending money with Morse code? Thankfully, technology has evolved since then, and nowadays, wire transfers can be done with a few clicks of a button or taps on a screen. Ah, the wonders of modern life.

2. How Wire Transfers Work

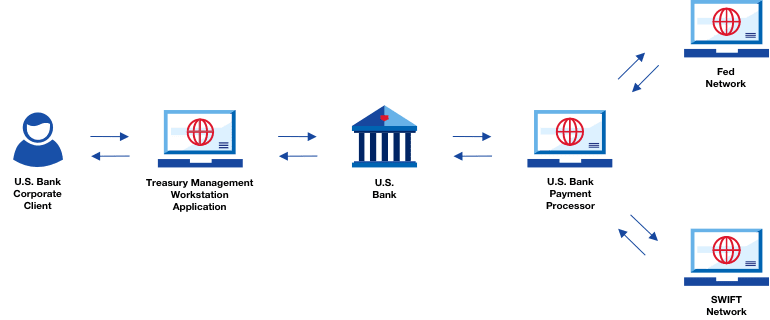

The Role of Financial Institutions

You might be wondering how your money magically travels through the interwebs and ends up in the right hands. Well, financial institutions, like banks or credit unions, play a crucial role in the wire transfer process. They act as intermediaries, ensuring that your hard-earned cash safely reaches its intended destination.

Step-by-Step Process of a Wire Transfer

Now, let’s break down the steps of a wire transfer. First, you’ll need to provide your financial institution with the necessary details, such as the recipient’s bank account number, their institution’s routing number, and any other relevant information. Then, your financial institution will initiate the transfer, sending the funds to the recipient’s bank. From there, the receiving bank will handle the rest, ensuring the money finds its way into the recipient’s account. Easy peasy, right?

3. Benefits and Advantages of Wire Transfers

Speed and Efficiency

One of the major perks of wire transfers is their lightning-fast speed. Need to send money urgently? No problem! Wire transfers can often be completed within a matter of hours or even minutes. Say goodbye to waiting days for a check to clear or an owl to deliver your gold coins.

Global Reach

Wire transfers are your ticket to financial freedom across borders. Whether you’re sending money to your Aunt Mildred in another country or paying for that dream vacation rental in Bali, wire transfers allow you to easily transfer funds internationally. Just make sure to factor in any international fees or exchange rates, which we’ll get to later.

Security and Traceability

When it comes to your hard-earned dough, security is key. Wire transfers offer a secure way to send money, with built-in measures to protect your funds from falling into the wrong hands. Plus, these transactions leave a traceable paper trail, providing peace of mind and making it easier to track your money’s journey through the financial maze.

4. Factors to Consider before Initiating a Wire Transfer

Costs and Fees

Before diving headfirst into a wire transfer, it’s essential to consider the costs involved. Some financial institutions charge a flat fee, while others may have a percentage-based fee. Additionally, keep an eye out for hidden charges that could sneak up on you like a stealthy ninja.

Exchange Rates and Currency Conversion

If you’re sending money across different currencies, exchange rates will come into play. Be sure to research the current rates and check if your financial institution offers competitive rates. After all, you want Uncle Sam to get the most bang for his buck, right?

Processing Time

While wire transfers are generally quick, the processing time can vary depending on a variety of factors. It’s worth checking with your financial institution to get an idea of how long it typically takes for funds to reach their destination. If you’re in a rush, you might want to consider alternative options like carrier pigeons or teleportation (just kidding!).

And there you have it, my friend! A crash course on wire transfers. Now you can confidently navigate the world of electronic money-moving with a spring in your step and a wallet full of knowledge. Happy transferring!

5. Common Fees and Charges Associated with Wire Transfers

Wire Transfer Fee

Sending money through a wire transfer may not always come for free. Financial institutions usually charge a fee for this service, which can vary depending on factors like the amount being transferred and the country involved. So, don’t be surprised if there’s a small dent in your wallet when initiating a wire transfer.

Foreign Exchange Fee

If you’re transferring money internationally, exchange rates come into play. Banks typically charge a foreign exchange fee to convert your currency into the recipient’s currency. This fee can sometimes be a percentage of the transfer amount, so be sure to factor it in when crunching the numbers.

Intermediary Bank Fees

When sending money across borders, intermediaries, such as correspondent banks, might be involved in the process. These intermediaries may charge fees too, which can apply to both the sender and the recipient. The charges can vary depending on the banks involved and may be deducted from the transfer amount.

6. Security and Safety Measures for Wire Transfers

Verification and Authentication Process

To ensure the safety of your funds, financial institutions have strict verification and authentication procedures in place for wire transfers. These measures may include confirming your identity, verifying the recipient’s details, and cross-checking the transaction against known fraud risks. These steps help protect both parties involved from potential scams or unauthorized transactions.

Protecting Against Fraud and Scams

While security measures are in place, it’s always important to be vigilant and take precautions against fraud and scams. Be cautious of unsolicited requests for wire transfers and verify the legitimacy of any transaction before proceeding. Additionally, regularly monitor your financial accounts and report any suspicious activity immediately.

Legal Rights and Consumer Protection

In case something does go wrong with a wire transfer, it’s good to know your rights and the level of consumer protection available. Familiarize yourself with the laws and regulations governing wire transfers in your country, as well as the terms and conditions set by your financial institution. This knowledge can give you peace of mind and help resolve any potential issues more efficiently.

7. Alternatives to Wire Transfers

Online Payment Platforms

If you prefer a quicker and more accessible transfer method, consider using online payment platforms like PayPal or Venmo. These platforms allow you to send money to friends, family, or businesses with just a few clicks. Plus, they often offer additional features like buyer protection and the ability to link to your bank account.

Mobile Payment Apps

With the rise of smartphones, mobile payment apps have become increasingly popular. Apps like Apple Pay, Google Pay, or Samsung Pay enable you to make secure payments directly from your phone. Some even allow for peer-to-peer transfers, making them a convenient alternative to wire transfers.

Peer-to-Peer Transfers

If you’re sending money domestically, peer-to-peer payment services like Zelle or Venmo can be a hassle-free option. These apps link directly to your bank account, enabling you to transfer funds to friends or family quickly. They often come with minimal or no fees, making them an attractive alternative to traditional wire transfers.

8. Conclusion and Final Thoughts

In a world where money can be transferred with a simple tap or swipe, wire transfers still hold their ground as a reliable and secure method for moving funds, especially across borders. While they may come with fees and require a little more effort, wire transfers offer the peace of mind that comes with a regulated and established system.

However, it’s essential to understand the associated costs and security measures involved. By being aware of the alternatives available and taking the necessary precautions, you can navigate the world of money transfers with confidence. So, whether you choose a wire transfer or explore other options, make sure your hard-earned money reaches its destination safely and swiftly.

8. Conclusion and Final Thoughts

Wire transfers offer a convenient and secure way to transfer funds globally, providing individuals and businesses with the ability to send money swiftly. While they come with certain costs and fees, the benefits of speed, traceability, and reliability often outweigh these considerations. However, it is essential to carefully analyze the fees associated with wire transfers, consider alternative options, and ensure that proper security measures are in place to protect against fraud. By understanding the intricacies of wire transfers and exploring other available methods, individuals can make informed decisions when it comes to transferring funds. Ultimately, wire transfers remain an essential tool in the modern financial landscape, playing a crucial role in facilitating seamless international transactions.

FAQ

1. Are wire transfers safe?

Yes, wire transfers are generally considered safe. They involve secure electronic transmission of funds between financial institutions, making them a reliable method for transferring money. However, it is important to follow proper security measures and be cautious of potential scams or fraudulent activities.

2. How long does a wire transfer take?

The timeframe for wire transfers can vary depending on several factors, such as the banks involved, the destination country, and any intermediary banks. Typically, domestic wire transfers are processed within the same business day, while international transfers may take a few business days or longer.

3. What are the alternatives to wire transfers?

There are several alternatives to wire transfers, including online payment platforms, mobile payment apps, and peer-to-peer transfers. These alternatives often offer faster transaction times, lower fees, and added convenience. However, the suitability of each alternative depends on factors such as the recipient’s location and the specific requirements of the transaction.

4. Can I cancel a wire transfer?

Once a wire transfer has been initiated, it is challenging to cancel or reverse the transaction. It is crucial to double-check all the details before confirming the transfer. If you believe there has been an error or fraudulent activity, contact your financial institution immediately to explore available options.